|

|

| Rating: 4.7 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: BMO Bank National Association |

BMO Digital Banking is a comprehensive mobile application designed for personal banking customers, offering convenient access to core banking features anytime, anywhere. Users can perform essential tasks like checking balances, viewing transaction history, transferring funds between accounts, and managing bills directly from their smartphone. It’s primarily for clients seeking a seamless digital experience to handle their day-to-day financial needs remotely.

This app provides significant value by replacing physical trips to the branch and saving time on routine financial tasks. Its appeal lies in offering powerful financial insights, personalized tools, and secure management capabilities all within an intuitive interface, making everyday banking faster, more informed, and highly accessible for millions of customers.

App Features

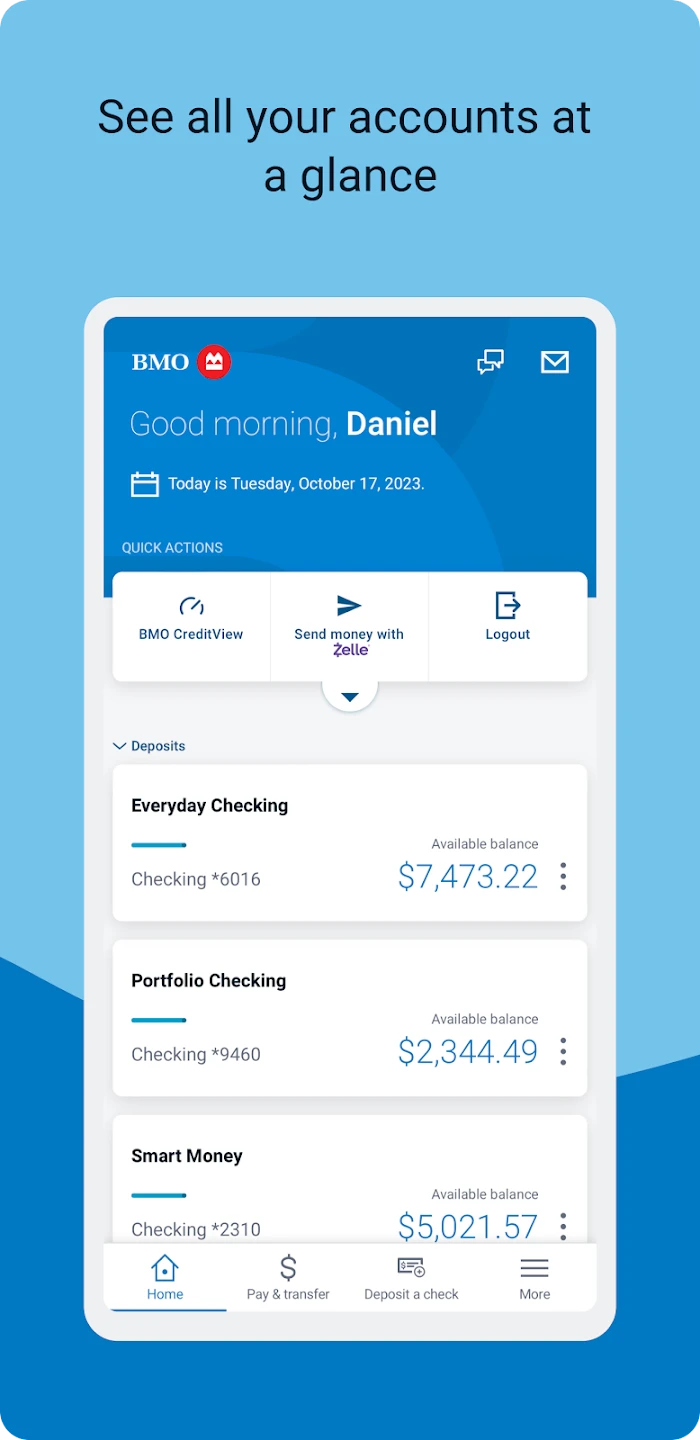

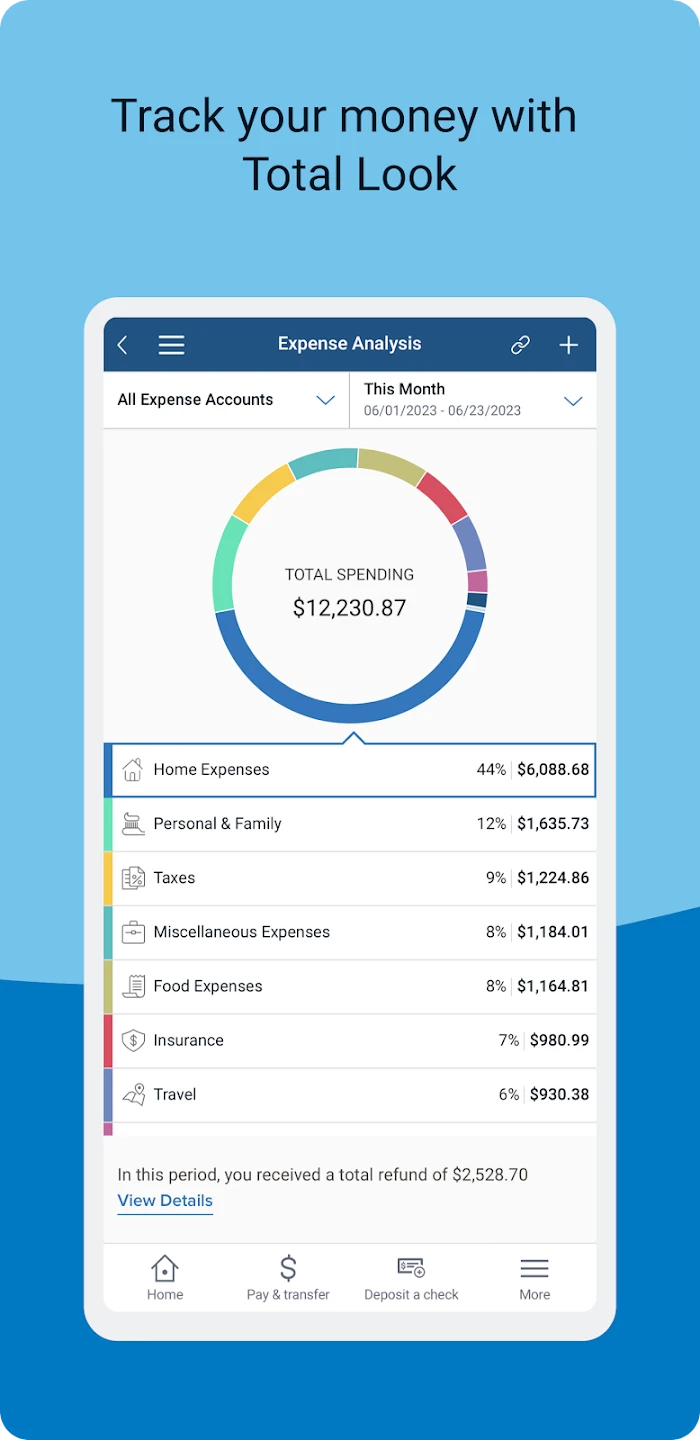

- Account Overviews & Insights: Get a quick snapshot of balances and recent transactions with customizable alerts. Users benefit from understanding their spending patterns and budgeting effectively through personalized summaries and spending categorization.

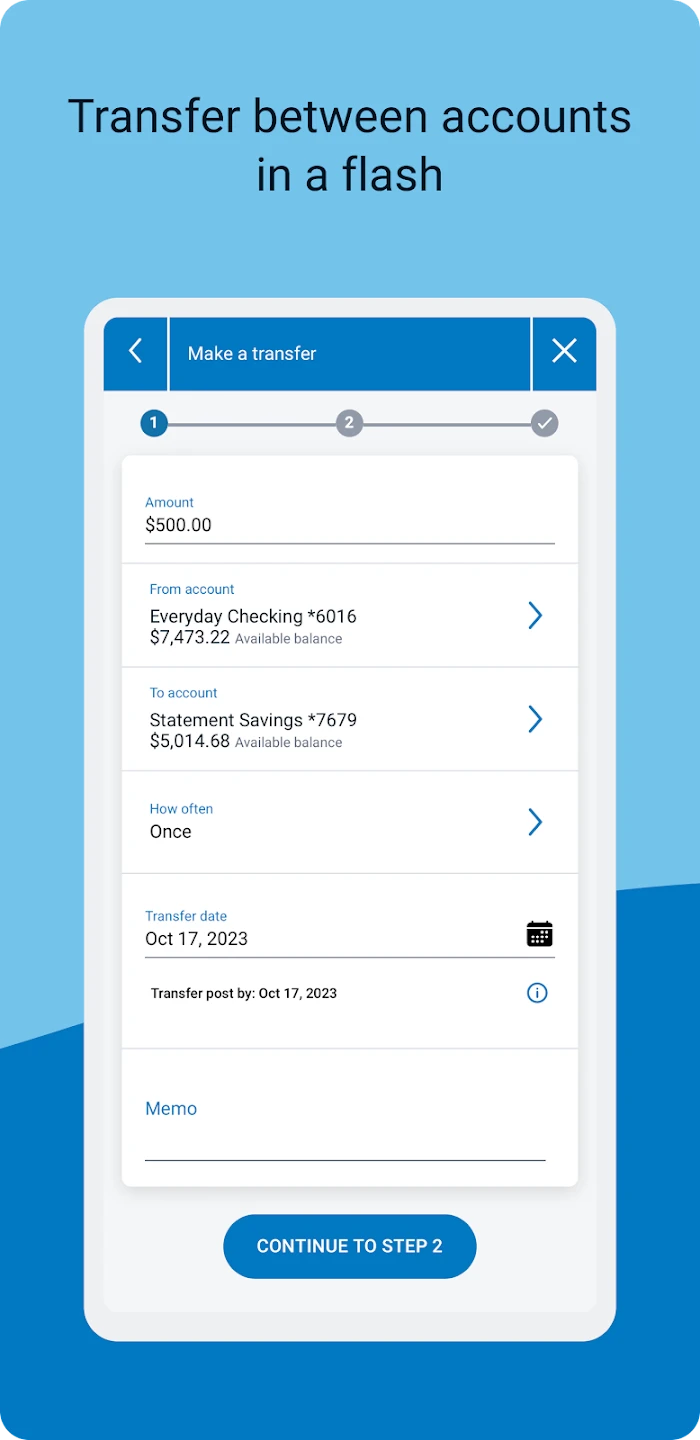

- Seamless Transfers & Payments: Instantly move money between your own BMO accounts or send funds securely to other individuals using various methods like routing and transit numbers, BMO card numbers, or PayID. This feature saves time by eliminating trips to ATMs or branches.

- Mobile Bill Pay & Management: Set up recurring payments for bills directly from the app and manage payment schedules. It solves the problem of tracking due dates and manually writing checks, offering convenience, especially for users with multiple recurring expenses.

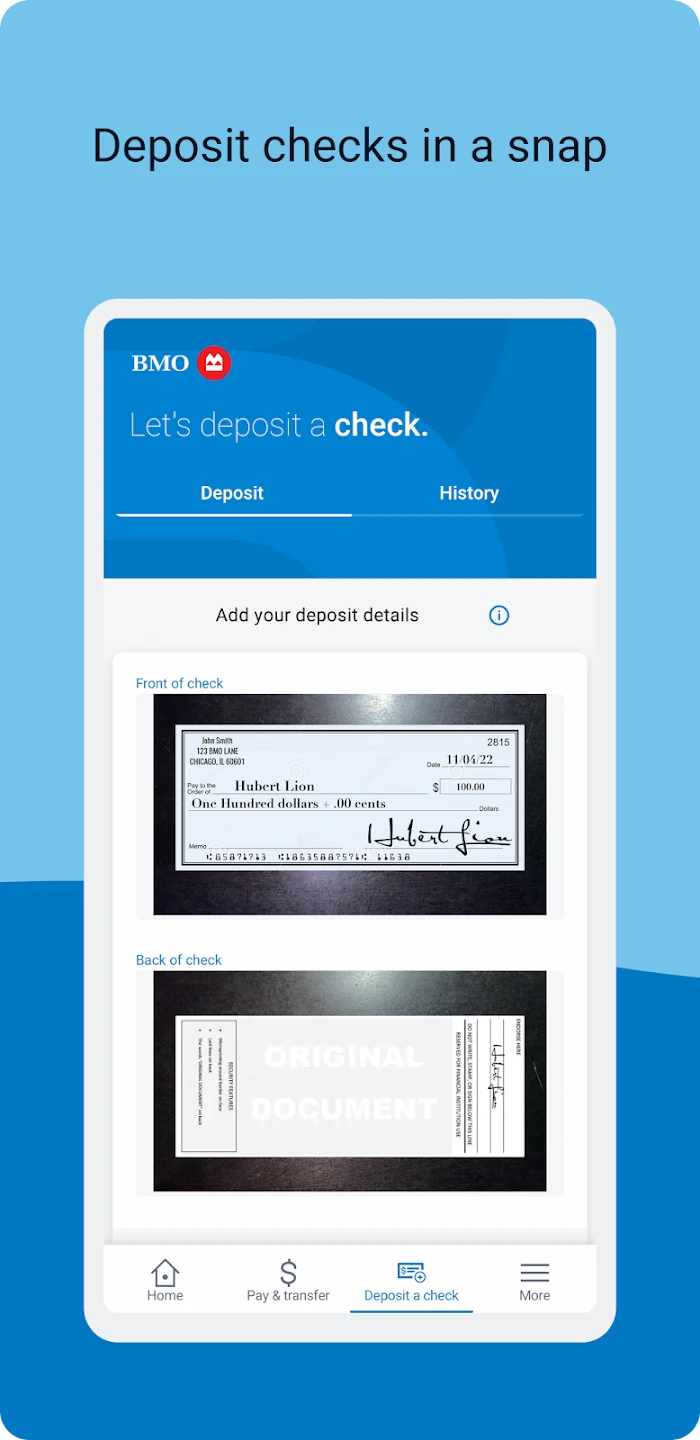

- Mobile Deposit: Deposit checks remotely by simply taking a picture with your phone’s camera, making funds available faster than waiting for a physical deposit at a branch. This feature is valuable for quick access to deposited funds, ideal for users needing immediate availability.

- Personalized Alerts & Notifications: Receive customized notifications for transactions, low balances, account activities, or offers relevant to your financial history and preferences. This helps users stay proactive about their accounts and catch potential errors or fraud promptly.

- Enhanced Security Features: Utilize biometric authentication like Touch ID or Face ID for secure logins, along with robust fraud detection systems and customizable security settings to safeguard your accounts and transactions. The multi-layered security approach provides peace of mind, essential for online financial management.

Pros & Cons

Pros:

- Highly convenient for everyday banking tasks

- Excellent mobile check deposit functionality

- Personalized financial insights and alerts

- Secure biometric logins enhance account safety

Cons:

- Limited features compared to full online banking

- Dependence on stable internet connectivity

- Some complex requests may still require branch visits

- Initial setup or troubleshooting might need support

Similar Apps

| App Name | Highlights |

|---|---|

| Chase Mobile |

This app offers a wide range of features including account management, mobile deposits, and integrated investment tracking. Known for comprehensive banking integration and robust security protocols. |

| TD Bank Mobile |

Designed for user-friendly navigation and includes mobile check deposit and budgeting tools. Focuses on ease of use and accessibility features. |

| Wells Fargo Mobile |

Offers advanced functionalities like mortgage management and investment services, alongside standard account controls. Known for its broad feature set and digital wallet capabilities. |

Frequently Asked Questions

Q: How do I set up and start using the BMO Digital Banking app for the first time?

A: You need a valid BMO account, a smartphone with internet access, and the BMO Digital Banking app installed. Log in using your BMO Online username and password, then follow the on-screen instructions to link and verify your accounts securely.

Q: Are my transactions and personal information secure when using the BMO Mobile app?

A: Yes, security is a top priority. We use advanced encryption, secure login methods like biometrics, and multi-factor authentication. Plus, our fraud monitoring systems constantly watch for suspicious activity to protect your accounts.

Q: Can I view all the same information available on the BMO website within the app?

A: The app offers key functionalities like account balances, transactions, transfers, and bill pay. For more detailed account management, specific investment analysis, or certain loan servicing tasks, you might need to use the full BMO Online banking platform.

Q: What are the limits for sending money using the app’s transfer feature?

A: Transfer limits depend on your specific account type and individual security settings. Standard limits apply for transfers to external accounts, and higher limits might be available for transfers between your own BMO accounts, subject to verification.

Q: Does BMO offer customer support specifically for issues with the Mobile app?

A: Absolutely. We provide support options, including app-specific FAQs, live chat, phone assistance, or email, designed to quickly resolve any issues you encounter while using the BMO Digital Banking Mobile application.

Screenshots

|

|

|

|