|

Venmo Rating: 4.2 Venmo: The Convenient Way to Split Bills and |

| Category: Finance | Downloads: 10,000,000+ |

| Developer: PayPal, Inc. | Tags: venmo | payment | bank |

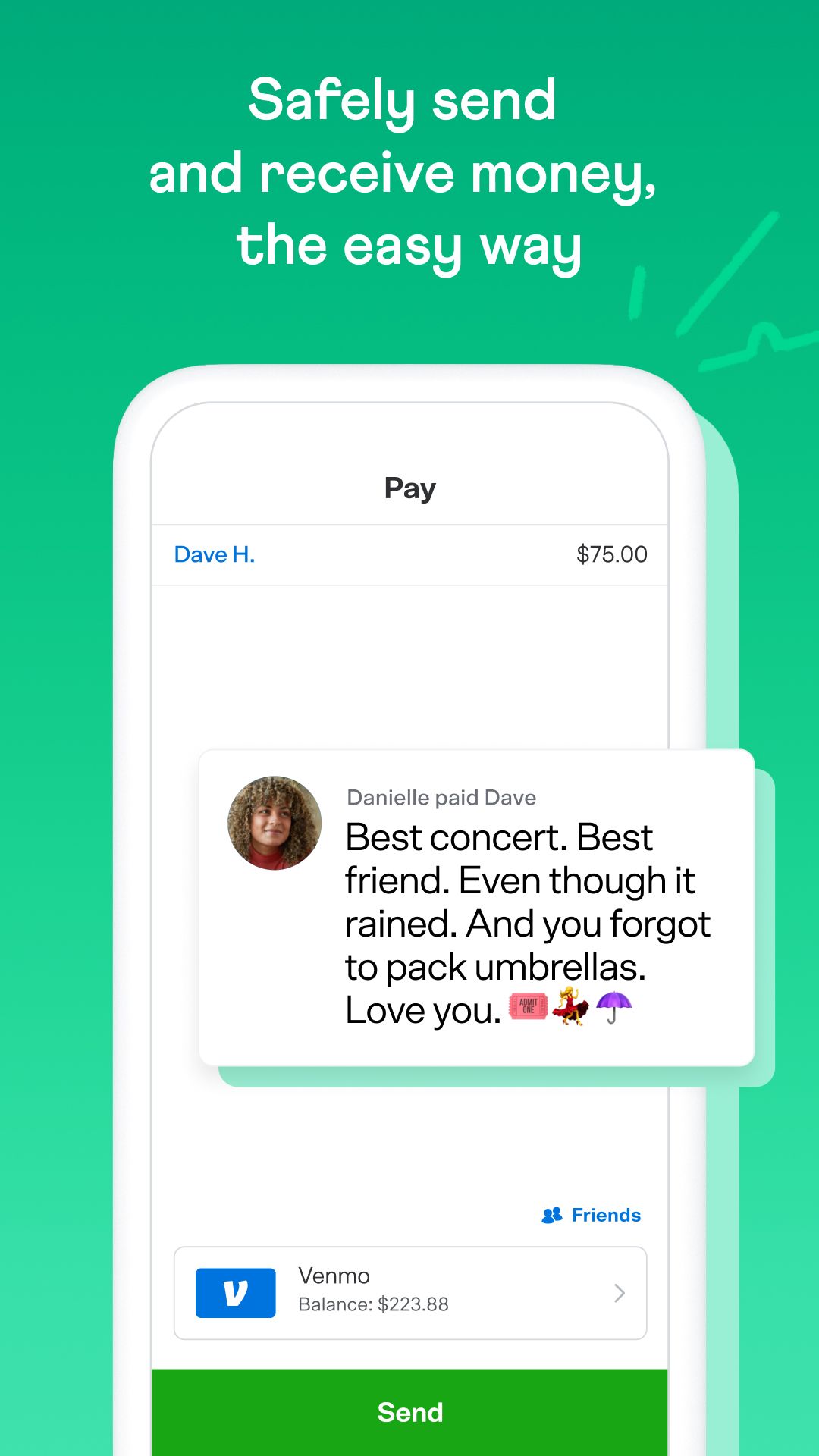

Welcome to the world of Venmo, the app that revolutionizes the way we handle payments and money transfers. With Venmo, sending and receiving money has never been easier. Whether you’re splitting a bill with friends, paying for goods and services, or simply sending money to family, Venmo provides a convenient and seamless platform to manage your finances. Let’s explore the features and benefits that make Venmo a popular choice for millions of users worldwide.

Features & Benefits

- Easy Money Transfers: Venmo allows you to send money to friends, family, or businesses with just a few taps on your smartphone. Simply link your bank account or credit/debit card to your Venmo account, and you can effortlessly transfer funds to anyone in your contact list. No more hassle of writing checks or dealing with cash.

- Splitting Bills Made Simple: Splitting bills with friends has never been easier. Whether you’re dining out, shopping, or organizing an event, Venmo lets you split expenses among multiple people. With just a few clicks, you can divide the bill and send payment requests to your friends, ensuring a fair and hassle-free process.

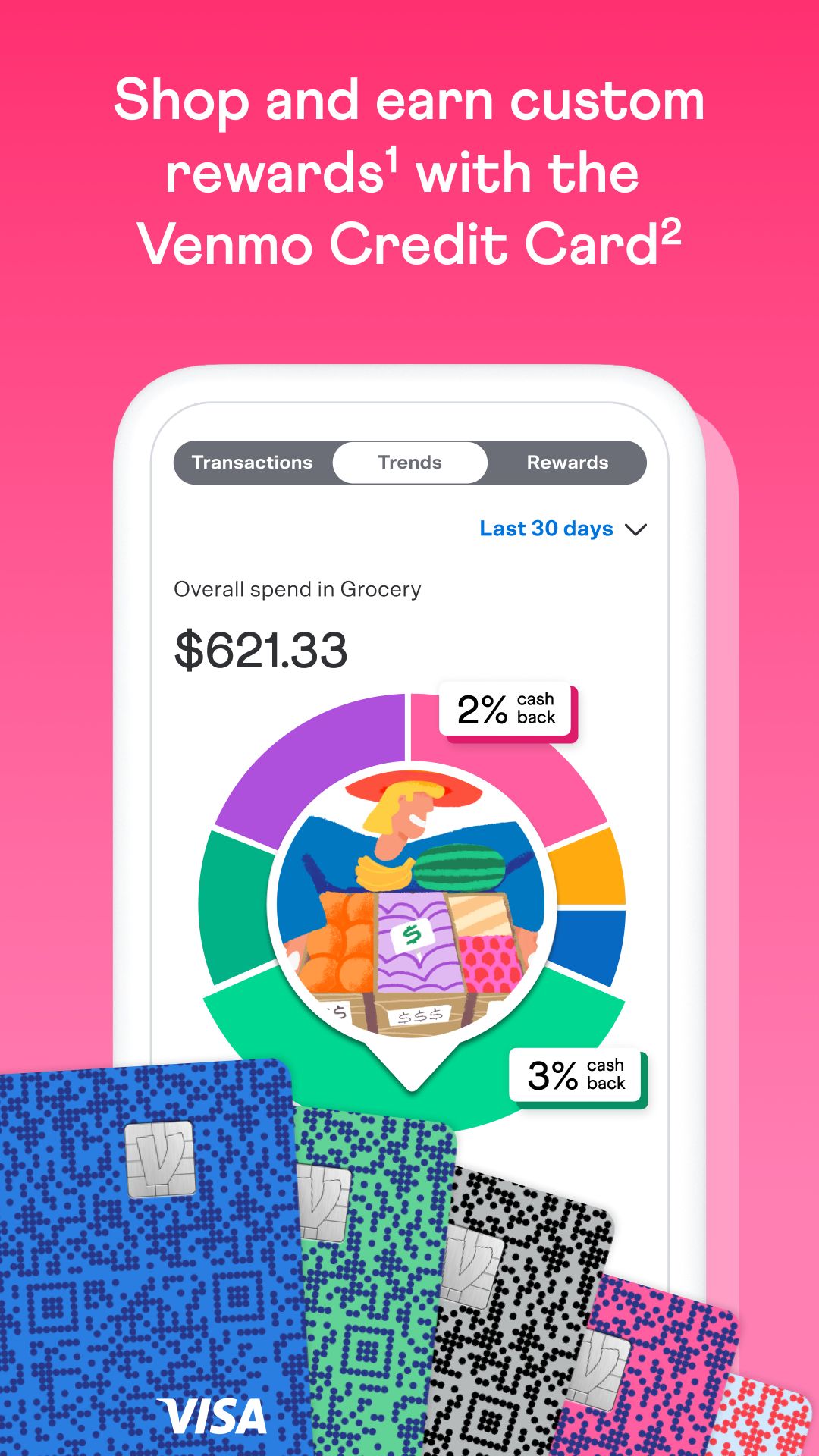

- Venmo Card: The Venmo Card is a physical debit card linked to your Venmo account. It allows you to make purchases at any location that accepts Mastercard, both online and offline. The card offers cashback rewards on select purchases, adding an extra benefit for frequent users.

- Social Integration: Venmo incorporates a social aspect, allowing users to share and engage with their transactions. This feature adds a fun and interactive element, with users having the option to add emojis, comments, and even customize transaction descriptions. It creates a sense of community among users and fosters a more engaging payment experience.

- Security and Fraud Protection: Venmo prioritizes security and offers fraud protection for its users. The app utilizes encryption and secure protocols to protect sensitive information. Additionally, Venmo monitors and detects suspicious transactions, providing an added layer of security for its users.

Pros

- Convenience and Simplicity: Venmo streamlines the payment process, making it incredibly convenient and user-friendly. Sending and receiving money is quick and straightforward, eliminating the need for cash or checks.

- Splitting Bills with Ease: Venmo’s ability to split bills among friends simplifies group payments. It takes the hassle out of calculating and collecting money, ensuring a smooth and efficient process.

- Social Integration: The social aspect of Venmo adds an element of fun and interaction to the payment experience. Users can engage with their transactions, adding personalized descriptions, comments, and emojis, making payments more engaging.

- Venmo Card: The Venmo Card provides users with a physical debit card linked to their Venmo account. It offers the convenience of making purchases anywhere that accepts Mastercard and provides cashback rewards on select purchases.

- Security Measures: Venmo prioritizes the security of user information and transactions. The app employs encryption and secure protocols, along with monitoring for suspicious activity, to protect users from potential fraud.

Cons

- Transaction Fees for Certain Services: While Venmo offers many free services, such as sending money to friends or family, there are transaction fees associated with certain services. For example, there may be fees for using Venmo to pay for goods and services or for instant transfers to your bank account.

- Limited International Use: Venmo primarily operates within the United States, which limits its availability for international transactions. International users may need to explore alternative payment options.

- Privacy Concerns: As Venmo incorporates a social aspect, some users may have privacy concerns about sharing their transactions and financial activities. However, Venmo provides privacy settings to control the visibility of transactions and allows users to customize their privacy preferences.

Apps Like Venmo

- PayPal: PayPal is one of the leading payment platforms globally and offers similar features to Venmo. It allows users to send and receive money, make online purchases, and split bills. PayPal also provides a range of security measures and is widely accepted by businesses worldwide.

- Cash App: Cash App, developed by Square, is another popular payment app that enables users to send and receive money, make purchases, and invest in stocks and Bitcoin. It offers a user-friendly interface and provides a Cash Card for making purchases.

- Zelle: Zelle is a peer-to-peer payment service integrated with major banks in the United States. It allows users to send money directly from their bank accounts, making it a convenient option for seamless transactions between individuals. Zelle emphasizes speed and security, aiming to provide instant and secure money transfers.

These three apps, like Venmo, provide convenient and secure ways to handle payments and money transfers. Each app has its unique features and benefits, catering to a wide range of user preferences. Whether you’re looking for social integration, investment options, or seamless bank transfers, these apps offer alternatives to Venmo in the digital payment landscape.

Screenshots

|

|

|

|

Conclusion

Venmo has revolutionized the way we handle payments and money transfers. With its easy-to-use interface, convenient features for splittingbills and making transactions, and the added social aspect, Venmo has become a popular choice for users worldwide. The Venmo Card provides additional flexibility, allowing users to make purchases both online and offline. While there are transaction fees for certain services and limited international use, Venmo’s convenience, simplicity, and security measures make it a top contender in the payment app market.

In a world where digital payments are becoming increasingly common, Venmo stands out as a reliable and user-friendly platform. Its integration of social features adds a unique touch to the payment experience, making transactions more engaging and enjoyable. Whether you’re splitting bills, sending money to friends and family, or making purchases, Venmo simplifies the process and offers a range of benefits.

Overall, Venmo has transformed the way we handle financial transactions, providing a convenient, secure, and fun platform for managing our money.